Trust Foundations: Ensuring Durability and Dependability

Trust Foundations: Ensuring Durability and Dependability

Blog Article

Strengthen Your Tradition With Expert Trust Foundation Solutions

In the world of heritage planning, the importance of establishing a solid structure can not be overstated. Expert trust fund structure options use a robust framework that can protect your possessions and guarantee your dreams are accomplished exactly as meant. From minimizing tax obligations to selecting a trustee that can competently manage your affairs, there are essential considerations that demand attention. The intricacies involved in depend on structures demand a calculated technique that aligns with your lasting goals and values (trust foundations). As we delve right into the subtleties of trust structure services, we uncover the crucial elements that can fortify your tradition and offer an enduring influence for generations to come.

Benefits of Trust Fund Structure Solutions

Depend on structure services offer a durable structure for safeguarding possessions and guaranteeing long-lasting monetary security for individuals and organizations alike. Among the key advantages of count on structure services is property security. By establishing a count on, individuals can protect their assets from potential risks such as legal actions, lenders, or unexpected economic responsibilities. This protection makes sure that the properties held within the depend on remain secure and can be passed on to future generations according to the person's dreams.

With trust funds, individuals can lay out exactly how their possessions must be managed and dispersed upon their death. Counts on additionally use personal privacy advantages, as possessions held within a trust are not subject to probate, which is a public and commonly prolonged lawful process.

Kinds Of Trusts for Heritage Planning

When thinking about tradition planning, an essential element entails discovering numerous kinds of lawful tools created to protect and disperse properties effectively. One common kind of depend on utilized in legacy planning is a revocable living count on. This count on enables individuals to preserve control over their properties throughout their lifetime while making sure a smooth change of these properties to beneficiaries upon their death, avoiding the probate process and providing privacy to the household.

An additional type is an irrevocable count on, which can not be modified or withdrawed when developed. This count on supplies potential tax advantages and shields properties from lenders. Charitable counts on are likewise popular for individuals aiming to support a reason while maintaining a stream of income on their own or their recipients. Special requirements depends on are necessary for individuals with impairments to ensure they get needed treatment and assistance without threatening federal government benefits.

Understanding the various sorts of trusts offered for legacy preparation is important in establishing an extensive approach that lines up with private objectives and concerns.

Selecting the Right Trustee

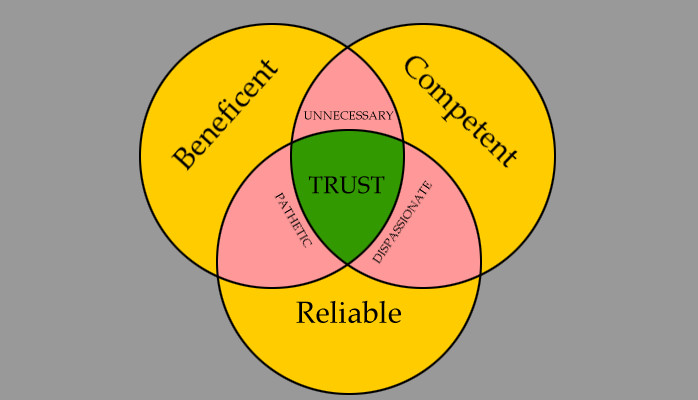

In the world of heritage preparation, an essential facet that requires careful consideration is the selection of a proper person to meet the essential function of trustee. Choosing the right trustee is a decision that can dramatically affect the Find Out More successful implementation of a depend on and the satisfaction of the grantor's dreams. When choosing a trustee, it is necessary to prioritize qualities such as trustworthiness, financial acumen, stability, and a commitment to acting in the very best rate of interests of the recipients.

Preferably, the selected trustee ought to have a solid understanding of monetary issues, be capable of making audio financial investment decisions, and have the capability to navigate intricate lawful and tax needs. Reliable communication abilities, interest to information, and a willingness to act impartially are also crucial characteristics for a trustee to have. It is suggested to select a person that is trusted, liable, and capable of fulfilling the duties and commitments connected with the role of trustee. By thoroughly taking into consideration these factors and picking a trustee who lines up with the worths and goals of the trust fund, you can aid make sure the long-lasting success and preservation of your legacy.

Tax Ramifications and Benefits

:max_bytes(150000):strip_icc()/trust-fund-4187592-1-58df0cb75cbc432090ea169f30193611.jpg)

Taking into consideration the monetary landscape surrounding depend on structures and estate preparation, it is extremely important to explore the intricate realm of tax implications and advantages - trust foundations. When developing a count site on, comprehending the tax effects is crucial for enhancing the advantages and minimizing potential obligations. Counts on offer numerous tax benefits depending on their structure and function, such as minimizing inheritance tax, revenue taxes, and gift tax obligations

One significant advantage of specific trust fund frameworks is the capability to move properties to beneficiaries with reduced tax repercussions. As an example, irreversible depends on can get rid of properties from the grantor's estate, possibly lowering inheritance tax responsibility. Additionally, some depends on permit revenue to be dispersed to beneficiaries, who may be in lower tax obligation brackets, leading to total tax obligation cost savings for the household.

However, it is necessary to note that tax obligation legislations are complex and conditional, highlighting the additional reading need of seeking advice from with tax specialists and estate planning specialists to guarantee compliance and take full advantage of the tax advantages of trust structures. Properly browsing the tax ramifications of trusts can cause considerable financial savings and a much more reliable transfer of wealth to future generations.

Actions to Developing a Count On

To develop a count on efficiently, meticulous interest to information and adherence to legal procedures are essential. The primary step in establishing a depend on is to plainly define the function of the depend on and the assets that will be included. This includes recognizing the beneficiaries who will certainly take advantage of the trust and selecting a reliable trustee to manage the assets. Next, it is critical to select the kind of count on that finest straightens with your objectives, whether it be a revocable trust fund, irrevocable depend on, or living depend on.

Final Thought

To conclude, establishing a trust structure can supply many benefits for legacy preparation, including asset defense, control over circulation, and tax advantages. By picking the proper kind of trust and trustee, people can protect their assets and guarantee their desires are performed according to their needs. Comprehending the tax obligation ramifications and taking the necessary actions to establish a trust fund can aid enhance your legacy for future generations.

Report this page